Everyone at the Pool Works in Member Services

Appropriate for all pooling professionals, this course explores how the concepts of consultative sales and effective communication apply to the daily responsibilities of all pool roles. It includes practical strategies to enhance interactions with members, ensuring members perceive the pool as a trusted and valuable resource. The course explains typical member services within pooling, enabling every role to appreciate how their contributions support the pool’s mission.

Build Your Pool’s Brand

This course is designed to help pooling professionals understand core principles of branding and how to build a strong, authentic brand that aligns with a pool’s mission and values. The course will help you identify, articulate and integrate your pool’s unique brand into daily operations, member communications and service delivery. Through practical strategies and real-world examples, this course will equip you to strengthen your pool’s brand identity, enhance member engagement and foster long-term success.

Pooling Basics

Pooling Basics courses are designed to offer learners a baseline understanding of core pool operations including governance, underwriting, claims, finance, risk management, member relations, and employee benefits. Within each course, learners will explore key concepts, learn from pooling experts, and engage with interactive exercises to increase their pooling knowledge and bring that knowledge to their own pools.

Finance Bundle

Pooling Academy’s finance courses help learners understand their pool’s financial practices and decisions. This bundle of three courses is most appropriate for finance professionals newer to pooling, other staff who could benefit from knowing the basics of pool financial practices, and governing body members to better understand the pool’s financial reporting and budgeting. The courses include lessons in financial reporting standards and practices, effective budgeting techniques, influences to a pool’s annual operating budget, and internal controls. Through insights from pool finance experts and interactive real-world pooling scenarios, learners walk away with a better practical understanding of pool financials that they can put into practice right away

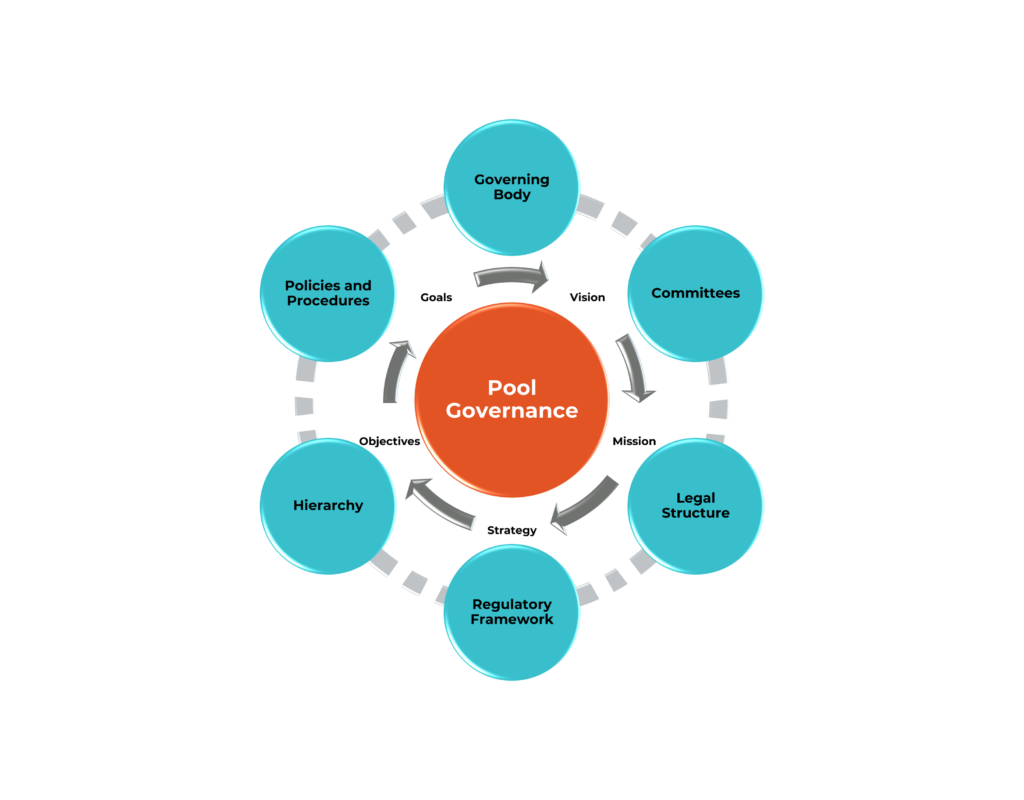

Governance Modes and Models

This course defines and explains three modes of governance used by all governing bodies and gives examples of how the modes apply within a pool’s governing environment. The course also provides an overview of structured governance models and typical pool governance approaches, describing their influence in practical terms.

Roles and Expectations of a Pool Governing Body Member

This course teaches the importance of written governance role expectations and what is typically expected from pool governing body members. Learners will explore ways to assess governance performance, common officer roles and responsibilities, and how a pool’s executive committee may function. Finally, learners will receive tips for recruiting, selecting, onboarding and planning for the succession of governing body members.

Financial Reporting Practices

Every pool has processes and practices to ensure adequate and transparent financial reporting, whether determined solely by its own financial policies and governing body, or required by a regulation.

At the end of a fiscal year, a pool will have its financial statements independently audited, with a corresponding report. Annual audited financial statements are an important foundation of pool financial reporting practices.In this course, we overview variations in pool financial reporting, describe how pools provide important financial reporting through their annual audited financial statements, and offer additional context helpful to understand pool financial reporting practices.

FREE: The Top 5 Influences on Pools Right Now

This special edition hot topic offers insight into the Top 5 Influences on Pools Right Now. For each influence, AGRiP Executive Director Ann Gergen identifies our shared pooling history, our current state, and where we might be headed in the future.

INFLUENCES

- Turnover

- Cyber Security

- Weather Patterns

- Well-Being

- Pooling Mindset

PLEASE NOTE: Be sure to use the “Login with AGRiP” or “Login with CAJPA” or “Login with NLC-RISC” buttons for your free course to show.

Planning for Continuity of Your Pool’s Operations Amid Any Disruption

This course discusses the goals of Business Continuity Planning and the importance of developing clear mitigation and response strategies to not only react and respond during an unexpected event but to thrive before, during, and after the event.

Attract and Retain Pool Members

This course is about member recruitment and retention strategies. It covers how to identify ideal members and effectively onboard them, and how to foster solid member relationships. You’ll learn practical methods to measure member engagement and address dissatisfaction, helping your pool build a thriving, engaged membership for long-term success. All pooling professionals can benefit from the information in this course. Member services staff and communication specialists will find this content directly relevant in their daily work.

Measure Member Engagement

This course provides ideas about how you can effectively assess and enhance member engagement at your pool. You will learn to differentiate between participation, satisfaction and engagement, and the importance of these metrics as you build lasting member relationships.

FREE: Build a Better Member Experience

This special edition, free hot topic course is about being quick, clear and kind as you work with the members of your pool. It is appropriate for everyone working on behalf of a public entity pool.

Member expectations are increasing faster than ever, so it’s important to align pool service with new demands. The course outlines actionable strategies to enhance responsiveness and empathy, which will help your pool develop strong and lasting member relationships.

PLEASE NOTE: Be sure to use the “Login with AGRiP”or “Login with CAJPA” or “Login with NLC-RISC” buttons for your free course to show.

Fiduciary Obligations in Pool Governance

This course teaches learners to effectively apply fiduciary principles in real-world pooling scenarios, helping them engage in responsible governance.

Learners will be introduced to the legal and ethical aspects of fiduciary duty, emphasizing the importance of maintaining trust and accountability.

Lastly, this course covers the importance of regular fiduciary training, the role of a pool’s general legal counsel in providing fiduciary guidance, and key pool practices for governing bodies to manage and monitor in order to fulfill their fiduciary obligations.

How Pools Can Help Public Entities Manage Cyber Risks

Cyber incidents are an evolving threat for public entities and an important issue risk pools are actively addressing. Pools can help member entities avoid or minimize the impact of cyber incidents. This hot topic course will discuss the importance of good cyber hygiene for public entities and five cyber hygiene practices pools can help prioritize. We’ll also identify other ways pools can support public entity practices to boost cybersecurity and resources that might be useful to pools and their members.

Internal Controls & Data Management

Internal controls are the mechanisms, policies and procedures used to ensure financial and accounting information integrity. Internal controls aid a pool in promoting transparency, accountability and fraud prevention. In this course, learners will explore the reasons why internal controls are vital to pooling, including important considerations for capturing and managing financial data.

Incorporating Cognitive and Demographic Diversity for Pooling Success

This course explores diversity and inclusion specifically as it relates to a pool’s culture, people and practices. We’ll define diversity and inclusion concepts, the benefits and power of inclusivity, and how to incorporate a diverse mindset into pool culture and operations.

Operating Budgets

Every pool must develop an accurate budget that adequately funds its operations and supports rate stability. This course overviews the types of budgets that may exist in a pool, including program, general administration, and capital asset budgets. It also describes common revenue sources and expenses within pooling, as well as other influences that may impact a pool’s annual operating budget.